Update risk parameters of assets on BSC, FTM and ETH lending pool

-

1. Idea

The market has changed a lot from the first day of Trava Lending Pool. The asset on the lending pool was updated up/down by its community, application and utility.- The LTV parameter determines the maximum amount that can be borrowed for a specific amount of collateral. The higher LTV, the higher the amount of borrow amount for an amount of collateral. In the meantime, higher LVT leads to higher risk for lenders if default happens.

- Regarding liquidation threshold, it is calculated as the weighted average of the liquidation thresholds of the collateral assets and their value. The lower the threshold, the more benefits for borrowers as remaining their borrowed assets . However, an unreasonable low level of liquidation threshold leads to the risks for lenders.

The change of risk parameters might benefit lenders, borrowers and Trava Lending Pool. Based on the reasonable change in parameters, users can help contribute in:

- Attracting new users with more attractive requirements for lending/borrowing.

- Making protocols safer with the bear market conditions.

2. Current status

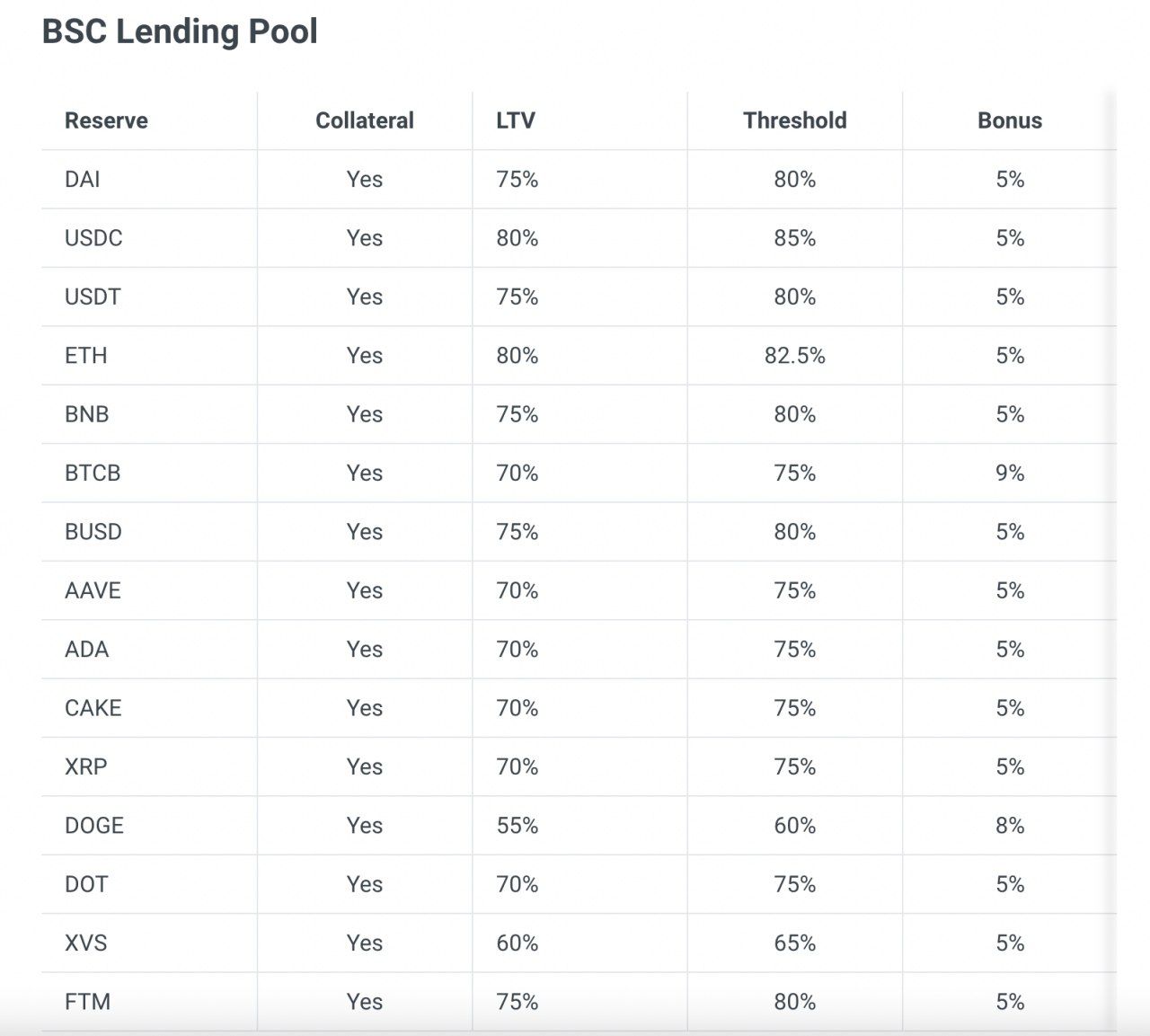

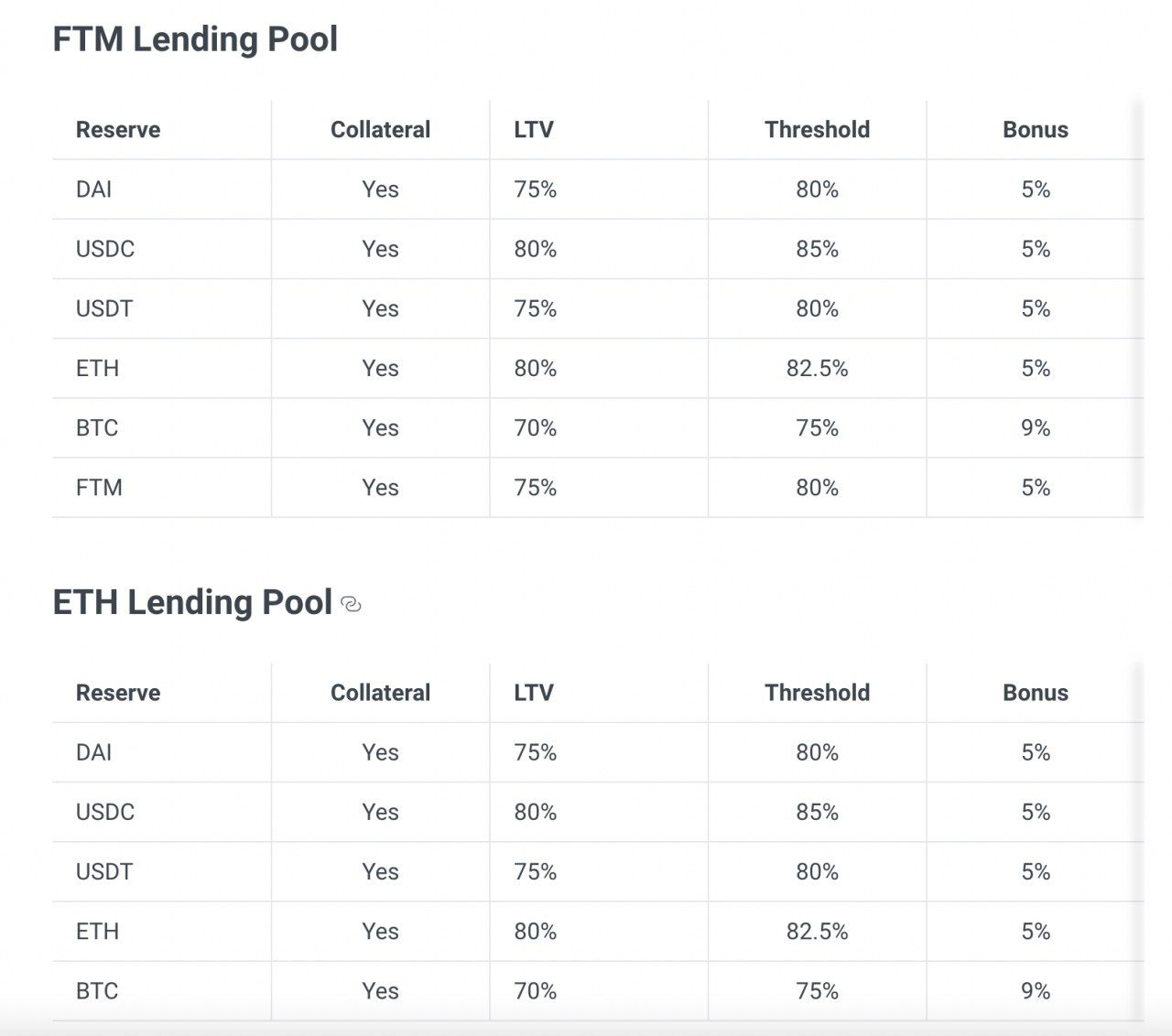

For now, the risk parameters are determined in our Lending Pool on 3 networks as follows:

In addition, we have currently been developing credit worthiness of tokens, called Token Health. The Trava Token Health model is now built based on 7 indicators, including: (1) Market Cap, (2) Number of transactions, (3) Trading volume, (4) Number of holders, (5) Distribution of tokens to holders, (6) Price, and (7) Price stability. It is a helpful tool for users to minimize the risks related to token price and liquidity, especially in the bear market situation.

Based on Token Health, users can easily evaluate and propose suitable parameters for each token in the Trava Lending pool to maximize the benefit of lenders, borrowers and our protocol.3. Discussion

Should we update parameters on our lending pool so that it brings more benefits for users as mentioned above? Any suggestions on calculation for the change of risk parameter? -

@thangtrava

Incentive to risk ratio is what we are looking at here in simple terms. New protocols with high risk need to have high APY to attract users. The risk is too much liquidity which can cause hyperinflation of the reward token. If you can add parameters in the smart contract that would trigger a burn on token supply based on percentages of rewards produced this would lower risk. It must be simple to understand for mass adoption. The Trava team would be able to connect this to the Token Health Model that would be very appealing to participants. Great work Trava! -

@thangtrava which new asset will be added in trava lending pool?

-

@shelterswap Yeah. Great idea on integrate token health model to our lending pool. Of course, we have plan for that. Intergrate credit score and token health to our lending pool is one of our goals

-

@s1018 Do you have any idea about the next assets in lending pool to discuss?

-

@thangtrava I like the potential of Bitgert (BRISE). https://www.coingecko.com/en/coins/bitgert.

Also the subnets on Avalanche (AVAX) are exciting. https://www.coingecko.com/en/coins/avalanche. -

@thangtrava I just noticed the TraDao bonding. I guess you guys have thought about this! Impressive.

-

@shelterswap Oh, bitgert is a new project. Can you give some brief intro about bitgert here before my team make some researches about them?

-

@shelterswap Yeah. TraDAO is a production in Trava ecosystem. The integration among them will be more clear and more powerful in the near future.

-

I for one love this idea

️

️ -

@thangtrava i would like to see solana in the lending pool.

-

@thangtrava 100,000 transactions per second with almost no cost. Bitgert has some pretty solid projects building in the ecosystem already. The one that jumped out at me was Brise Paradise. https://briseparadise.com/wp-content/uploads/2022/03/white-paper.pdf. They are connecting crypto to real estate.

-

@s1018 Solana is a good asset. How do you think about the parameters for this one?

-

@shelterswap Yeah. My team will check for this solution and get back to you with some conclusion.

-

there are more than 14 assets in Lending pool now, I wonder when Trava or TOD would be added to, thing it would benefit trava holders alot.