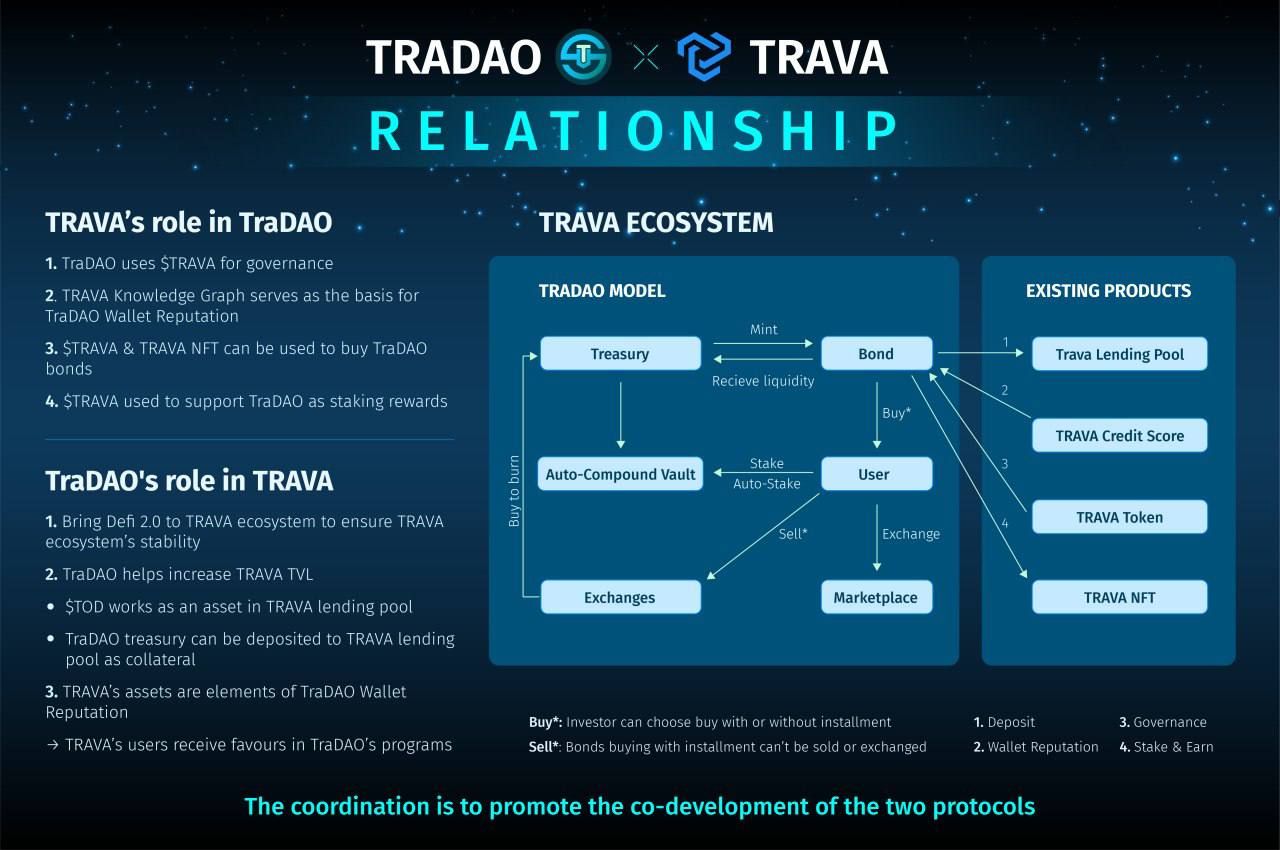

@s1018 Trava Finance ($TRAVA) x TraDAO ($TOD) x NFT Program (Trava Knights) are all part of Trava Ecosystem and support each other. Please take a look at the picture below to understand the Trava Ecosystem better

Best posts made by Kel

-

-

@aliénor-0 Yes, rTRAVA (Royalty Trava) is a unique Token which is gained only from when performing Lend/Borrow via Trava Lending Pools and can be collected via Dashboard.

rTRAVA incentives are bigger APR% in Trava Staking Vaults and rTRAVA also will have more voting power with Governance feature.

rTRAVA is sort of a loyalty token for Trava users which will be playing an important role in Trava Ecosystem.

rTRAVA --> TRAVA (ratio 1:1)

TRAVA --> rTRAVA

-

I would suggest to start with adjusting/changing/restructuring (idea 2.) the landing page and creating simple drop-down menu options with hyperlinks to different Trava Finance products like Trava Lending Pools; Trava Staking Vaults; Trava NFT Product; Trava Capital; Trava Governance etc.

Also add a feature to manually stop or finish/end the 3D animation as there were reports of the animation not loading up.

Creating a user-friendly landing page is one of the priorities for better user experience.

Additionally, Trava Finance lending product team should start working on adding more tokens to "Token Health" so they could be added to pool creation once the product is 100% finished - having more tokens available for pool creation feature is an advantage to attract more userbase and investors.

Lastly, I like the (idea 4.) - creating more DeFi investment options to explore in DeFi Cryptospace is great for expanding community knowledge about investment possibilities and also making the BRicher tool more flexible. Having more protocols/chains/networks to choose from can expand the use-case of the tool.

-

Hey @jefe811, nice question. Let me expand here a little..

Why TOD Token price has decreased?The TOD asset value has plummeted due to multiple reasons.

- Whitelist wallet allocations attract P&D users who do not intend to hold assets for longer periods of time and most of the time dump their assets once Token is launched for trading.

- BSC Network overall is more oriented to giveaway/airdrop hunters, IDO/ICO (whitelist) hunters, P&D, early benefit/incentive users who leave after competition or event is over. Due to low gas fees.

- Narrative on DAO's in Crypto Space is pretty shaky with examples like OHM; TIME; plummeting even harder. Investors adapt and learn during the course of the cycle, thus, many users just stay away from DAO's as they have a negative example happening previously.

- Single wallet has made a big purchase during the launch and has dumped it's Tokens after whitelist allocations have started being unlocked. Users take advantage of Token listings sometimes creating fake hype or even FOMO by pushing the price up significantly, expecting more users to join in the buying frenzy then later using them as exit liquidity.

- More and more users tend to realize their profits immediately, especially during bull run within the market cycle, rather than taking the longer route and accumulating the bag over the course of upcoming years. That is why even some of the whitelist allocations were sold of after unlock.

What gives value to Tokens? What affects the price?

-

Utility (Crypto token that serves some use case within a specific ecosystem)

-

Supply and demand (The higher the demand and lower the supply, the higher the price and vice versa)

-

Cost of production (PoW / PoS. Equipment or assets needed to generate more assets and their costs)

-

Environment Conditions (BTC for now is always the father/papa of crypto assets prices, ETH has also influence for altcoins usually. That means if BTC drops -> ETH drops -> altcoins drop and vice versa)

-

Local Conditions (Referring to local network recent PA, narrative, news - (TOD is launched on BSC-Binance Smart Chain))

-

Competition (If a new competitor gains momentum, it takes value from the existing competition, thus sending the price of the incumbent down as the new competitor's token sees its price move higher)

-

Governance (Stable governance where things are relatively hard to change can be of value by providing more stable pricing)

-

Availability on exchanges (If a cryptocurrency becomes listed on more exchanges, it can increase the number of investors willing and able to buy it, thus increasing demand)

-

Power of the media (Good news can certainly increase it, while bad news can cause panic)

-

Financial crises (Economic situation in the world)

Which ever crypto asset or project you will do research on the main factor will always be Supply and demand. If there is no demand within investor base, no new holders - the price will decrease if the token is inflationary as supply is increasing constantly.

Utility and power of the media can create demand and being unique from competitors gives an additional edge in the Crypto game.

That is why TOD still has additional utility yet to be implemented like becoming an asset available to Lend/Borrow in Trava Lending Pools. TOD is also planned to be integrated to Trava NFT Program. And currently we can see Wallet Reputation and user loyalty being taken into account which will benefit higher rank users/wallets with better Bonding discounts, higher APY%, option to take bigger debts via Bonding Installment and longer repayment periods and more benefits in the future too.

To wrap this up, I would like everyone to look at DeFi more than just actual today price of the Token and simple trading - that usually means you overinvested or bought at ATH and are expecting for the price to return. By staking, bonding, rebasing your assets you are able to grow your portfolio and outweigh your losses which might have happened due to recent negative price action. Personally, even with current TOD price and "plummeting" chart, playing the Game Theory with rebase TOD Token and Bonds allowed me to stay stable with supply increase and price decrease and actually being in profit today. This eventually becomes an additional passive income source where your daily stake/rebase rewards can be sold off as profit while the amount staked/rebasing does not change, finding this balance of reward ratio.

-

Hello @sir-kuana.

Unfortunately, we cannot comment on any potential exchange listing platform or timeline. What we can confirm is that negotiations are happening and new CEX listing is always in plans, but requires good market conditions and approvals from both parties first, the exchange and the project.Kraken

Listing on Kraken Exchange is pretty much impossible, they do not list Tokens randomly and the asset count available is low compared to other exchanges plus most of them are #100 Top assets.Etoro

Same as Kraken, the asset size list available for trading is low and only selected few are available. Again at least #100 Top Tokens.Gate.io

Gate Exchange could theoretically damage the price of TRAVA Token due to airdrops for their exchange users, which they dump immediately after event is completed, plus projects have to donate Tokens for this event. MEXC and Bitmart listing are a perfect example. Plus Gate is not that renown, there are better exchanges to look at.LBank

Same logic as Gate.Binance and KuCoin

These two exchanges are more likely to be on the list for the Trava Team to do negotiations with. Though listings on both exchanges are quite costly. But if I had to guess, these two exchanges are more likely to happen than any of the above. -

Hello @victoriaph. Could you please describe how would you intend to use Treasury funds to make profitable investments. As I understand the Treasury main task it be a reserve for Buyback in-case $TOD price drops to critical levels - 1$.

Other Treasuries are used for Development ant Technological advancements, like paying wages/salaries. Distributing a portion of it to Community, Marketing as well.

I am interested to hear what do you mean by use the money in the Treasury to make profitable investments, please explain and provide suggestions or examples.

-

Hello @thangtrava.

How come that you are considering meme tokens as addition to Lending Pool assets?

Floki Inu and Shiba Inu?AVAX; XLM; TRX; LTC; LINK - I would suggest to have a discussion about these assets as next addition to the Trava Lending Pools.

-

Hey @jefe811. Yes, security is one of the most important factors overall in Crypto Space nowadays and especially in DeFi Space as well with lots of other finance projects getting hacked / "hacked" or even rugging. That is why security has always been the top priority for Trava Finance and 2 audits were completed prior to even launching Lending Pools, Staking Vaults. Attaching relevant audit information below, you can find the reports from both audit projects as well.

- Hacken Medium: https://medium.com/trava-finance/trava-announces-second-successful-audit-collaboration-with-hacken-e78ae306a6a0

- Hacken report: https://hacken.io/audits/#trava_finance (there is a download button near Trava Finance audit)

- CertiK Medium: https://medium.com/trava-finance/trava-audit-completion-by-certik-705988ecc307

- CertiK report: https://www.certik.com/projects/travalist

I would like to point out that contract codes which have auto-top ups / Token reimbursements coded are usually the ones which are more susceptible to hack attacks. That is why Trava Finance tops up contracts running out of Tokens, like bridge, staking vaults, LP vaults, lending contracts, manually by setting up notification bots to alert relevant Team members to complete the top-up. Additionally, Team is constantly reading the latest news and hacks happening in Crypto Space and investigating contract code particularities which were the point of attack.

Another point - Trava Finance does not support flash loans due to flash loan attack possibilities, but other projects like AAVE do support them. That is why we do not see TRAVA as an asset within Lending Pools as using other project protocols it could lead to TRAVA's Token price downfall if it were to be used in flash loan attack scheme.

I would also like to invite @ducTrava to share his knowledge and clear any doubts about Trava Finance DeFi security.

-

Hey @jasonmar. It has been advised by the TraDAO Owner that Bonding Installment will be added gradually to each asset. So I suspect after a couple of weeks USDT will have Bonding Installment option as well. For now regular Bonding with USDT is available

-

Hey @mazz086. Indeed having $TRAVA as an asset to be able to Lend/Borrow via Lending Pools would provide the necessary utility. However as @theunreal has mentioned above, TRAVA Token cannot be added as an asset to Lending Pools as of this moment at least due a few reasons.

Trava Finance does not support flash loans in Lending Pools, but other project protocols like AAVE do. By staging a flash loan attack via other project protocols users could destroy TRAVA price like it happened with CREAM for example.

Current low price, current low circulating supply does not allow TRAVA to be an asset in Lending Pools quite yet. But that is why TraDAO ($TOD) should take it's place in the near future as an asset to be available for Lend/Borrow since it's backed up by a Treasury controlled by TraDAO protocol itself.