Hey @jefe811, nice question. Let me expand here a little..

Why TOD Token price has decreased?

The TOD asset value has plummeted due to multiple reasons.

- Whitelist wallet allocations attract P&D users who do not intend to hold assets for longer periods of time and most of the time dump their assets once Token is launched for trading.

- BSC Network overall is more oriented to giveaway/airdrop hunters, IDO/ICO (whitelist) hunters, P&D, early benefit/incentive users who leave after competition or event is over. Due to low gas fees.

- Narrative on DAO's in Crypto Space is pretty shaky with examples like OHM; TIME; plummeting even harder. Investors adapt and learn during the course of the cycle, thus, many users just stay away from DAO's as they have a negative example happening previously.

- Single wallet has made a big purchase during the launch and has dumped it's Tokens after whitelist allocations have started being unlocked. Users take advantage of Token listings sometimes creating fake hype or even FOMO by pushing the price up significantly, expecting more users to join in the buying frenzy then later using them as exit liquidity.

- More and more users tend to realize their profits immediately, especially during bull run within the market cycle, rather than taking the longer route and accumulating the bag over the course of upcoming years. That is why even some of the whitelist allocations were sold of after unlock.

What gives value to Tokens? What affects the price?

-

Utility (Crypto token that serves some use case within a specific ecosystem)

-

Supply and demand (The higher the demand and lower the supply, the higher the price and vice versa)

-

Cost of production (PoW / PoS. Equipment or assets needed to generate more assets and their costs)

-

Environment Conditions (BTC for now is always the father/papa of crypto assets prices, ETH has also influence for altcoins usually. That means if BTC drops -> ETH drops -> altcoins drop and vice versa)

-

Local Conditions (Referring to local network recent PA, narrative, news - (TOD is launched on BSC-Binance Smart Chain))

-

Competition (If a new competitor gains momentum, it takes value from the existing competition, thus sending the price of the incumbent down as the new competitor's token sees its price move higher)

-

Governance (Stable governance where things are relatively hard to change can be of value by providing more stable pricing)

-

Availability on exchanges (If a cryptocurrency becomes listed on more exchanges, it can increase the number of investors willing and able to buy it, thus increasing demand)

-

Power of the media (Good news can certainly increase it, while bad news can cause panic)

-

Financial crises (Economic situation in the world)

Which ever crypto asset or project you will do research on the main factor will always be Supply and demand. If there is no demand within investor base, no new holders - the price will decrease if the token is inflationary as supply is increasing constantly.

Utility and power of the media can create demand and being unique from competitors gives an additional edge in the Crypto game.

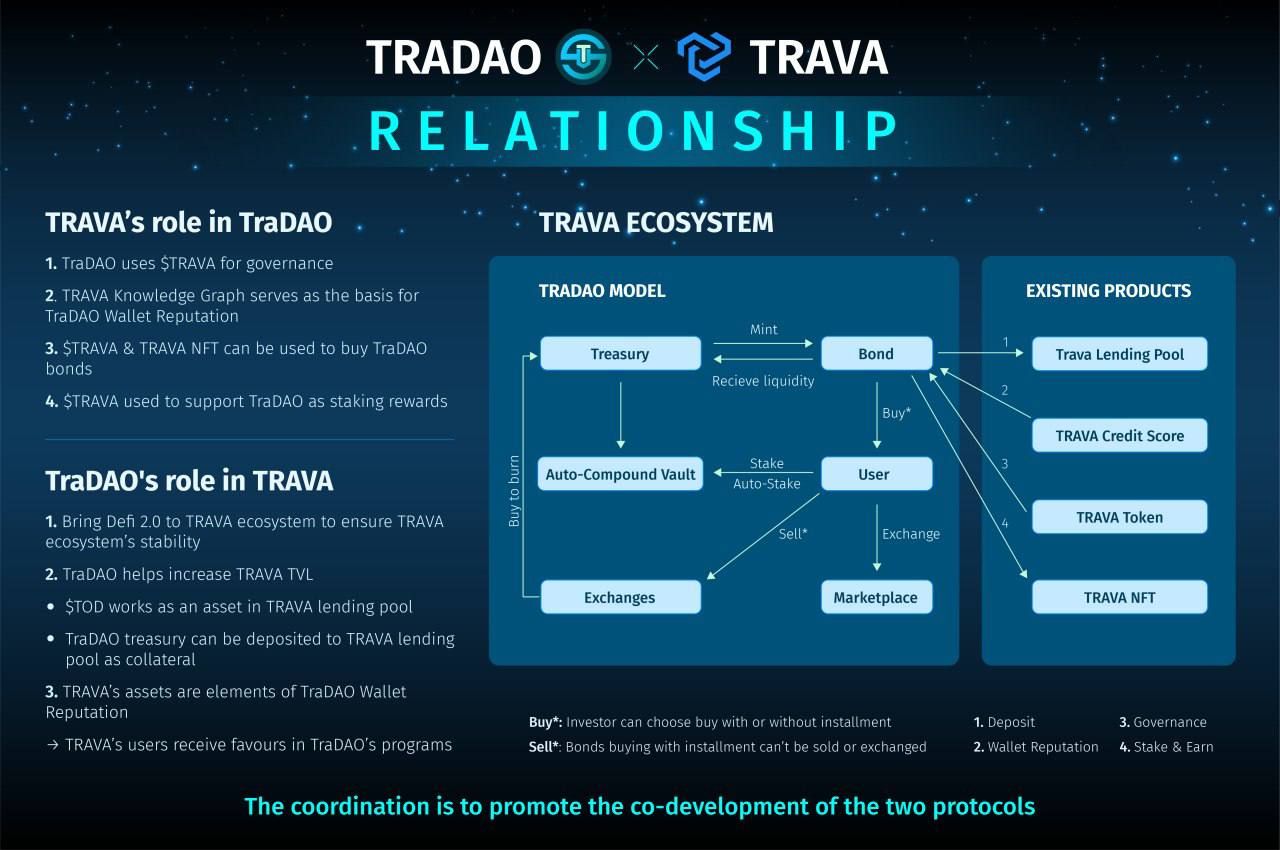

That is why TOD still has additional utility yet to be implemented like becoming an asset available to Lend/Borrow in Trava Lending Pools. TOD is also planned to be integrated to Trava NFT Program. And currently we can see Wallet Reputation and user loyalty being taken into account which will benefit higher rank users/wallets with better Bonding discounts, higher APY%, option to take bigger debts via Bonding Installment and longer repayment periods and more benefits in the future too.

To wrap this up, I would like everyone to look at DeFi more than just actual today price of the Token and simple trading - that usually means you overinvested or bought at ATH and are expecting for the price to return. By staking, bonding, rebasing your assets you are able to grow your portfolio and outweigh your losses which might have happened due to recent negative price action. Personally, even with current TOD price and "plummeting" chart, playing the Game Theory with rebase TOD Token and Bonds allowed me to stay stable with supply increase and price decrease and actually being in profit today. This eventually becomes an additional passive income source where your daily stake/rebase rewards can be sold off as profit while the amount staked/rebasing does not change, finding this balance of reward ratio.