@thangtrava One more thing, you can only convert rTRAVA to TRAVA but can not convert TRAVA to rTRAVA

Posts made by thangTrava

-

-

@aliénor-0 rTRAVA and TRAVA have similar values. However, at the moment, rTRAVA can only be obtained through the use of a lending pool. Meanwhile, you can trade TRAVA on centralized exchanges (MEXC, Bitmart) and decentralized exchanges (Pancake Swap, Spooky swap and Uniswap)

-

1. Idea

rTRAVA is the reward for users who lend/borrow on Trava Lending Pool. As mentioned in some article before, rTRAVA holders have their own voice on the governance process. The rTRAVA holders get share from profits gained from Trava Lending Pool. rTRAVA now becomes an essential part of the development in the Trava ecosystem. And we would like to create as many utilities as possible for rTRAVA in the future. The idea of Bridge for rTRAVA across BSC/FANTOM will help in:- Building strong connection among our lending pool.

- Increasing utilities for rTRAVA and TRAVA in the ecosystem.

- Making the fair among rTRAVA holders for the Governance Process across three networks.

2. Current Status

Only TRAVA Bridge across BSC/FANTOM is available now: https://app.trava.finance/bridge- Minimum TRAVA per transaction is 500

- Maximum TRAVA per transaction is 50,000

- Maximum TRAVA per day is 500,000

- Fee = 2% * amount converted + 20 TRAVA

3. Discussion

Should we create the rTRAVA bridge across BSC/ETH/FANTOM network? If so, which fee and bridge parameters are suitable? -

1. Idea

The market has changed a lot from the first day of Trava Lending Pool. The asset on the lending pool was updated up/down by its community, application and utility.- The LTV parameter determines the maximum amount that can be borrowed for a specific amount of collateral. The higher LTV, the higher the amount of borrow amount for an amount of collateral. In the meantime, higher LVT leads to higher risk for lenders if default happens.

- Regarding liquidation threshold, it is calculated as the weighted average of the liquidation thresholds of the collateral assets and their value. The lower the threshold, the more benefits for borrowers as remaining their borrowed assets . However, an unreasonable low level of liquidation threshold leads to the risks for lenders.

The change of risk parameters might benefit lenders, borrowers and Trava Lending Pool. Based on the reasonable change in parameters, users can help contribute in:

- Attracting new users with more attractive requirements for lending/borrowing.

- Making protocols safer with the bear market conditions.

2. Current status

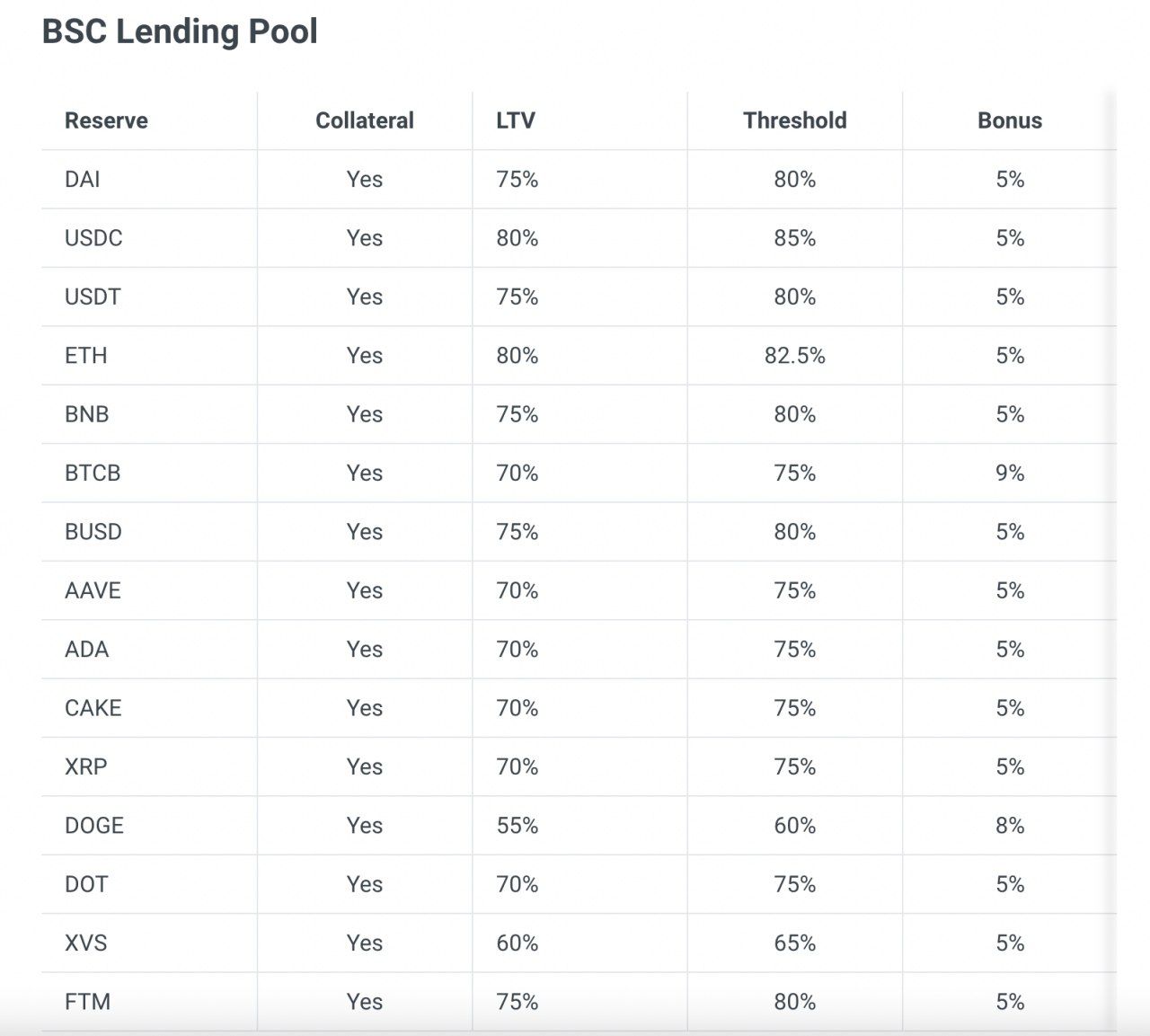

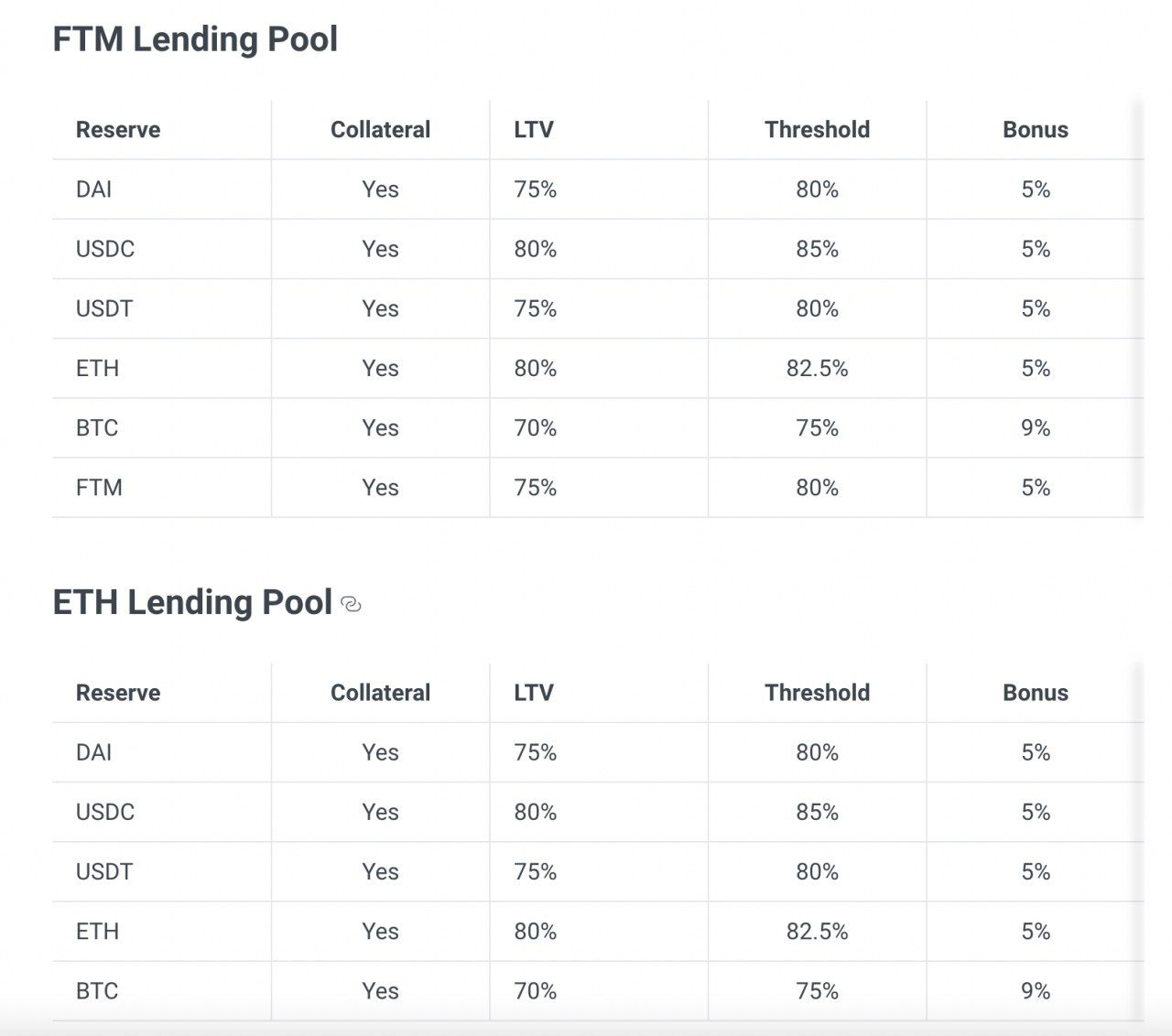

For now, the risk parameters are determined in our Lending Pool on 3 networks as follows:

In addition, we have currently been developing credit worthiness of tokens, called Token Health. The Trava Token Health model is now built based on 7 indicators, including: (1) Market Cap, (2) Number of transactions, (3) Trading volume, (4) Number of holders, (5) Distribution of tokens to holders, (6) Price, and (7) Price stability. It is a helpful tool for users to minimize the risks related to token price and liquidity, especially in the bear market situation.

Based on Token Health, users can easily evaluate and propose suitable parameters for each token in the Trava Lending pool to maximize the benefit of lenders, borrowers and our protocol.3. Discussion

Should we update parameters on our lending pool so that it brings more benefits for users as mentioned above? Any suggestions on calculation for the change of risk parameter?